A Look Into the 1811 SAP Commerce Cloud Release

As we’re all familiar with, SAP releases new editions of SAP Commerce Cloud approximately every 3 months. Their latest release, 1811 (“18” for 2018, “11” for November) came with the promise of, “Maximiz[ing] productivity and agility for quick time to market.” Did SAP live up to their own marketing tagline? Let’s take a look at a few features on offer, based on the 1811 release notes. I’ll share some of my thoughts; you draw your own conclusions.

As we’re all familiar with, SAP releases new editions of SAP Commerce Cloud approximately every 3 months. Their latest release, 1811 (“18” for 2018, “11” for November) came with the promise of, “Maximiz[ing] productivity and agility for quick time to market.” Did SAP live up to their own marketing tagline? Let’s take a look at a few features on offer, based on the 1811 release notes. I’ll share some of my thoughts; you draw your own conclusions.

Backoffice Product Content Management Dashboard

The release notes promise, “Realtime insights into your product data, including data quality coverage, product approval, & collaboration”. I love dashboard as much as the next person, but my take is that this feature area is a mixed bag.

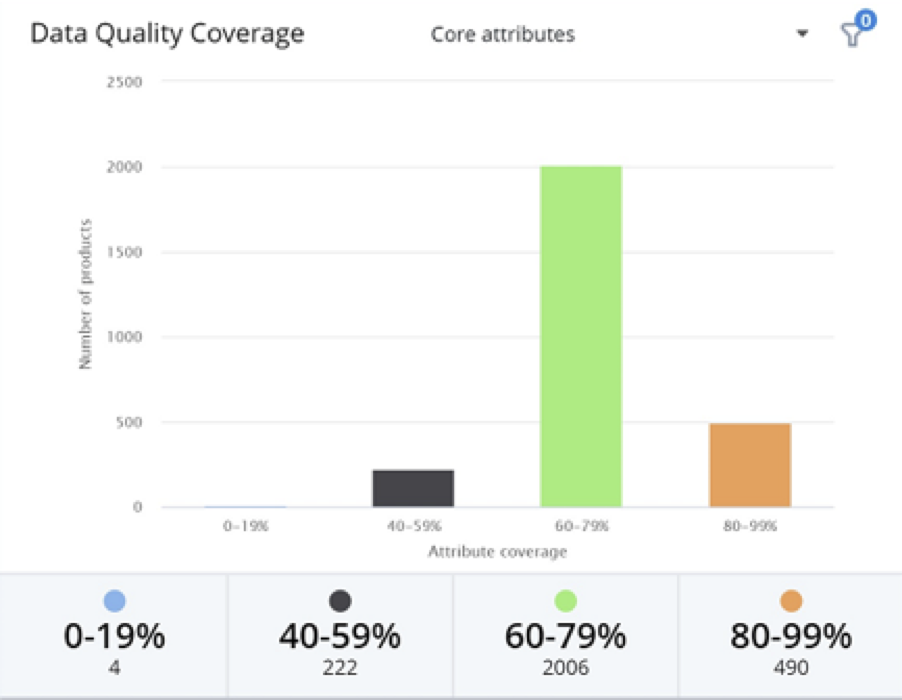

Let’s start with data quality coverage. Here’s a look:

I like the visualization. Very quickly I can tell if there are “disaster” products (eg. 0%) from a data quality coverage standpoint. Likewise, the ability to differentiate between “core” and “marketing” attributes in this visual seems like a smart thing. There is also a filtering ability that lets a merchandizer narrow the scope of products to one or more categories or catalogs.

But here I start to feel I’m left wanting. Yes, there is a filtering mechanism; however, why limit it? Why not have the ability to filter any way I want, thereby increasing the utility of this visualization? Same goes for the attribute modes. Why not have an ability to specify which attributes I care about? I’m sure SAP Commerce Cloud could be customized accordingly, but the point here is that the merchandizers that use the Backoffice PCM don’t want to have to rely on IT to customize something. If they need to get something done, let them filter as they wish with more advanced abilities. Large organizations in particular often have multiple people with specific duties, and each may need their own, unique blend of filters, such as “all products in all categories belonging to brand X”.

Also curiously lacking is the “100% coverage” column. Presumably this is absent as most systems would have the majority of their products in this column, and therefore this number would be large compared to the other columns. This, in turn, would make the other columns really small due to the changed vertical scale of the graph. Still, context can be important. It’s good to get a feel for what is good/working, so that the imperfect/not working data is put into perspective. (10 out of 100 is much worse than 10 out of 1,000.) This point is amplified when you consider that you can change the products being viewed via filtering, etc. As an idea, maybe simply putting a label underneath the graph citing the total amount of products considered by the graph (ie. 0-100%) would be a good way to add context.

Next up is product approval. Here’s a look:

The claim here is, “the ability to identify bottlenecks in the product approval cycle”. I’m not convinced. Most solutions in “steady state” operation would show a high percentage of products in the “approved” state, so you’re typically going to have “small slices” here for everything that’s not approved. This graphic doesn’t really add a lot of value in my mind. If I wanted to see “stuck” products, some sort of visualization around the “wait” or “processing” time would be more useful I think. Is the product approval cycle bottlenecking on a particular individual? A particular brand? A particular attribute that is always blank and difficult to obtain data for?

This visual also permits for filtering like in the data quality coverage graph. The same filtering options apply, and my same critique about more flexible filtering applies.

Strange is the inclusion of the “Add new product” link. How is that related to identifying bottlenecks?

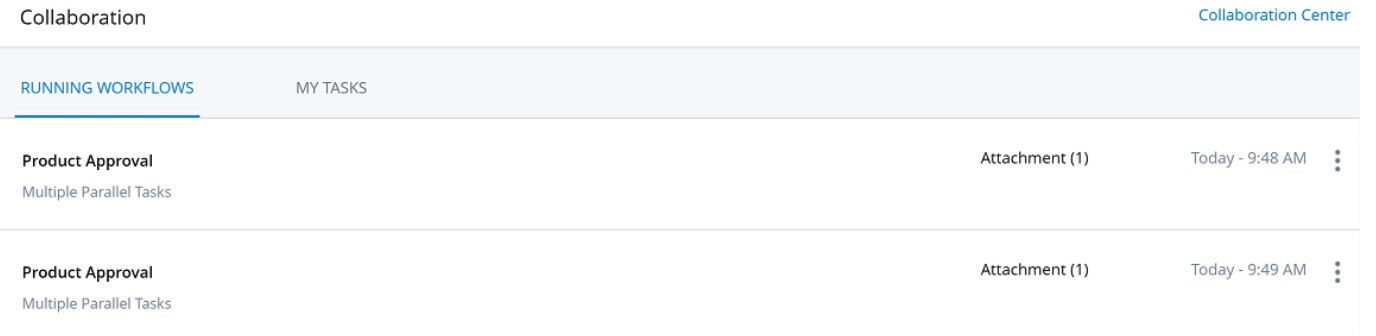

Lastly, we have collaboration. Here’s a look:

Perhaps my favourite piece of this new dashboard, this table allows you to quickly see what workflows are running and which tasks are waiting on you. The release notes do not explicitly say, but I presume the list of running workflows is workflows related to me (eg. I initiated it, I am the “next” person to action this workflow) to cut down on the “noise” of “all” workflows that might be running. Clicking on a workflow will let you see the details, and there is also an ability to see a visualization of the entire workflow.

This section of the dashboard seems to do justice the realities of someone doing day-to-day operations within the Backoffice PCM. I can see all of my tasks at a glance, and likewise I can view other workflows easily so that I can poke a collegues upstream or downstream from me in the workflow if there is an element of coordination needed. (eg. “Hey, could you deal with product X before lunch? I have an appointment I need to go to and I need to review & approve your attribute data before 2pm.”)

One idea to improve it would be to swap the order of the tabs – I believe more common would be the desire to see “My Tasks” than “Running Workflows”.

SAP-ification of the UI?

One thing that caught my eye when reading about enhancements to SmartEdit was a one-liner, citing, “Application Header Redesign”. Sounds fancy. But the description way even more revealing:

“The header redesign is part of an ongoing effort to move toward a unified user experience across SAP’s entire portfolio with common functions, controls, look and feel”

Let’s be honest – Hybris of old was never in a position to win any UX awards – especially for its Backoffice. Under SAP, the rebranded SAP Commerce Cloud has definitely improved in the UX department (SmartEdit being a good example), but it still often feels like an exposed data model at times. Now factor in the statements above and we see there is an intent on SAP’s part to unify the Hybris-UX-of-old (and-UX-of-not-so-old) with that of the broader SAP portfolio of products. Will the “SAP-ification” of the SAP Commerce Cloud Backoffice continue? Likely. Will we see an SAP Fiori Backoffice UI for SAP Commerce Cloud in the future? Maybe. But I doubt it. Will the new SPA (Spartacus) headless commerce front end UI be influenced by “SAP UI-isms”. Possibly, though probably lightly at best since it is supposed to be a snazzy, appealing storefront to an end consumer. My point here is that it appears there is a shift in thinking around the UX within SAP Commerce Cloud. That could be a good thing, though with any change there will likely be elements we like and don’t in the releases ahead.

JALO Dependencies

Since ancient times when I first started with (then called) Hybris, JALO was the layer under the scenes that did a lot of the grunt work. Around the v5 era, Hybris released the newer, more flexible and extensive “Service Layer”, which promised to herald a new era of JALO-free platform code. Fast-forward through the v5, v6, and 18## releases and we still have JALO today.

1811 could be the first release with SAP making a serious attack on finally killing JALO. Two highlights from this release make we wonder this.

First, there is the “Jalo-Logic-Free” extension, as exhibited by the new “yvoid” extension template and the converted “yempty” and “yhacext” extensions. To be clear, the name is misleading. These are not “JALO free”. They are free of custom JALO logic/code. But hey, it’s a start.

The other, more interesting change is the “redesigned cart calculation logic”, which is now free of JALO dependencies. In my mind, this is a solid engineering/refactoring investment, as cart calculation is often at the epicenter of a myriad number of different features (think: promotions, coupons, discounts, taxes, shipping, bundling, etc.) and therefore is an area at risk for “whack-a-mole” type of bugs when introducing code changes. In addition to the advertised benefits of improved extensibility, one could infer that if JALO can be quashed in this area, then that is one (more) major hurdle cleared to quashing JALO everywhere.

Integrations

SAP has made good on some of their recent acquisitions in this release. While every release typically has some integration additions or enhancements, this release brings into the fold SAP Customer Data Cloud (formerly Gigya) and SAP CPQ (formerly CallidusCloud, and not to be confused with the “old” SAP CPQ). Both of these are smart choices.

The acquisition of SAP Customer Data Cloud is a good play by SAP to address the realities of GDPR. Its integration with SAP Commerce Cloud makes a lot of sense, as issues around consent and privacy naturally fall within the boundaries of a typical e-commerce solution since these solutions are typically the “glass” customer touch to interact with an organization online. And of course consent and privacy are omni-channel concerns, so having a centralized point like SAP Customer Data Cloud to handle these facets and ensure compliance makes a lot of sense for many organizations. Integrating SAP Customer Data Cloud and SAP Commerce Cloud together therefore makes for a powerful story, increasing the value of the commerce proposition to prospective clients.

Similarly, the acquisition of CallidusCloud by SAP has allowed for a more interesting SaaS-based CPQ (Configure, Price, Quote) play. While SAP Commerce Cloud is good at handling “regular” pricing (including promotions & discounts), and also has elements of product configuration, bundling, and product customization (eg. engraving your name on a locket), many industries have complex product configurations or pricing models that require a dedicated tool to support. Therefore, this integration too is a good play for SAP, opening up this newly acquired CPQ tool and strengthening their cloud-native based offerings and stories.

Overall, a solid play by SAP.

The Great Purge

If you have been following the deprecation and sunset notices from prior releases, you will have noted that Q4 2018 had been building up towards what I’m calling, “The Great Purge”. This is where SAP Commerce Cloud was (finally) supposed to jettison a lot of the older code, such as the old cockpit framework and the associated cockpits. It didn’t happen. At least not in this release.

Officially, these modules and extensions are still on the chopping block, and if you have a live solution you should be planning/preparing for the demise of this part of the code base. But the fact that they were not purged “on schedule” implies that something is holding SAP back. Perhaps too many customers haven’t migrated to the newer Backoffice yet? Perhaps there’s too much focus on other areas of the development roadmap to attend to this? Your guess is as good as mine.

One module that shouldn’t cause any tears to flow for its removal is the old BTG (behavioural target groups) module. When turned on, this was a known performance drag on the solution. Replacing it with more modern options like SAP Marketing Cloud or Context-Drive Services will likely be a win for many organizations.

Accelerators

One growing concern I have is the lack of attention from SAP to their “core” (ie. B2C, B2B) accelerators. Neither the 1811 release nor the previous 1808 release contained any updates to core their accelerators. This represents approximately 6 months of inattention and a dearth of innovation in this area. Now we all know and recognize SAP Commerce Cloud’s #1 positioning with Forrester and Gartner (read SAP Kool-Aid here for Forrester and here for Gartner); however, this inattention in my mind creates an opportunity for SAP Commerce Cloud competitors, such as Salesforce Commerce Cloud, commercetools, and a myriad of others, to close in and, potentially, overtake SAP Commerce Cloud in this area. In the spirit of the “sex sells” marketing mantra, accelerators are ultimately the thing that customer “touch” and “feel”. The accelerators are SAP Commerce Cloud to most customers, despite the fact that you & I understand that they are really just the tip of the iceberg, with all sorts of cool tech underneath. From my experience with customers, this is an area SAP should return its focus to keep its leading position.

Side note – Immune from my scorn is the Telco accelerator team, who did put out a fresh update with their 1810 Telco accelerator update. Keep it coming!

But What About…?

There is of course more to this release, and unfortunately I cannot cover it all. Still, make note of these other interesting features areas and check them out for yourself:

- Fine-grained permissions support for SmartEdit

- Personalization enhancements

- Switch from yassconfiguration to API Registry

- Integration APIs

- SAP Cloud Platform Extension Factory Integration

- New & enhanced integrations with other SAP products

Back to SAP’s own marketing tagline, “Maximiz[ing] productivity and agility for quick time to market.”

Time to draw your own conclusions. Agree? Disagree? Maybe something I didn’t cover? Did SAP realize in this release what their marketers taglined, “Maximiz[ing] productivity and agility for quick time to market”? Leave a comment below with your thoughts. And be bold. ?